Written by Marga Mingoa

Getting your life on track is one of the biggest challenges ever. How do independent people do it? There are so many different factors to independence and there are numerous varieties of challenges that we could face. I’m not an expert but, here’s what I learned and a list of things to get you started:

DISCLAIMER: Article ahead may include a personal story or two. If you’re in a hurry, just grab the checklist or save to read later!

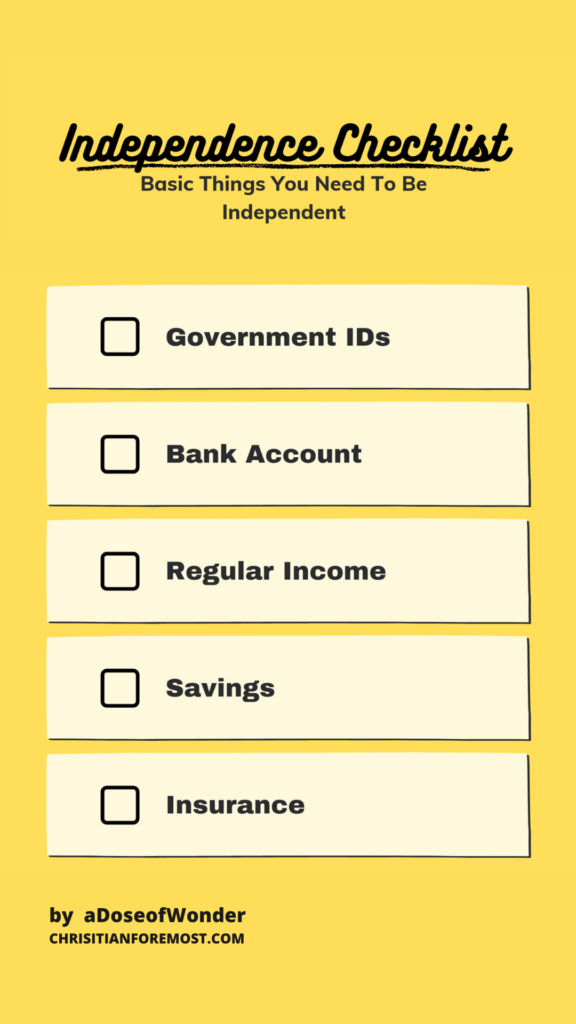

Independence Checklist: 5 Basic Things You Need to be Independent

1. Government IDs (at least 2)

When I was a student, I got away with using my school ID for most things. When you enter real life, you need at least two government IDs. Why? ID is short for Identification. Not everyone knows you personally so they need proof. This is also a requirement for most things in life like a job application, a bank account, or an insurance policy.

2. Bank Account

As kids, we didn’t need bank accounts. We just needed allowance from our parents. As adults, having a bank account is necessary.

I opened a bank account for myself when I was in college. It was such a proud moment for me since I did it all by myself. My mom didn’t even know about it right away. I put my allowance there so I would never forget my allowance at home or lose it when I accidentally drop my money somewhere.

Eventually, my balance went under the minimum amount since I kept withdrawing my allowance and was emptied by bank service fees. Then I decided not to touch it since I didn’t need my bank account anymore and after a few years, it closed. It was a really poor choice of judgment for me at that time. Fast forward to the time that I actually needed a bank account for my 1st job as an online English teacher, I needed a bank account for my professional fees. The biggest headache of it all? I did NOT have any valid IDs because I lost them in a house fire a few months before I got my first job. I had to wait months before I could replace my valid IDs! Oh, the irony of it all. Lesson learned: keep your bank account active!

3. Regular Income

Remember my story about my bank account that closed? I probably should’ve worked harder to find a steady stream of income during my college years to keep my bank account active.

Looking for a job during a global pandemic is hard. If you need help with online job interviews, make sure to check out Christian’s blog on how to Nail Online Job Interviews with these 8 Helpful Tips!

4. Savings

It is pretty obvious why you need savings. This is probably the most basic one on the list. As a licensed financial advisor and mom of three I just cannot stress this enough. Savings is an amount you put away for future dreams and goals, and for rainy days.

My word of advice is to set a goal so won’t touch your savings until you reach that goal. I’m a member of various money-saving Facebook groups and this is the most mentioned topic. Saving is hard, but it’s not impossible. You can do it! Just set your goal and discipline yourself.

If you’re struggling with your budget, send me a message. I’m open to consultations for free, of course. Get in touch with me through my Facebook page: The Budget Baby or through my email: margaretmaryangela.r.mingoa@sunlife.com.ph.

5. Insurance

In the Philippines, we have SSS (Social Security), Pag-Ibig (Housing Load), Phil-health (Health Care), etc. Yes, they’re a lot. Why do you need insurance? These are all nice to have but they serve very differently, useful, distinct purposes.

You have insurance from your company? Great! Although FYI, company and government insurance is usually set only to minimum benefits. If you do have these benefits, you have to know the details. I hate to get technical but, in some cases, there are personal plans that offer 200% of the face amount. For example, 1M face amount, if death benefit is 200% of the face amount, your family will get 2M. It is best to get at least one personal plan and get it through a financial advisor.

Do you think you’re too young to have insurance? Do you plan to get sick before getting insurance for yourself? I would recommend V.U.L. (A.K.A. investment-linked) insurance. If you’re not ready for that yes, go for traditional plans.

Insurance is expensive? Yeah, I used to think the same way before I became a licensed financial advisor. Prevention is better than a cure. Same with insurance. Insurance is better than being penniless when an emergency hits. To be frank, insurance is cheaper than costly medical bills or funeral expenses. You never know if something happens to you. *knock on wood*

Also, you should know that there are insurance plans that have rebates if nothing happens to you within the policy contract. There are honestly so many details that go into insurance. If you’d like to know more, schedule a free consultation with me through my Facebook page: The Budget Baby or through my email (margaretmaryangela.r.mingoa@sunlife.com.ph).

So far, these are the things that I think make someone independent. Did I miss anything? Tell me what you think in the comments section and I might just make a part 2 for this topic.

About the Author

Love this blog? Pin it!

Share this blog and tag your friends!

Being independent is a great step in every person’s life. Sometimes it comes sooner than expected, so it’s best to be prepared. Great tips to follow, thanks for sharing!

You’re completely right about all of these, they are absolutely needed and not optional at all. It can be intimidating to step into being independent but it’s supper necessary.

The Savings one is something I’ve never joked with. I find living without saving fills me with trepidation and fear of the unknown. Thanks for the list – others are useful, too.

yes! I can’t agree with this list more. When I started living by myself it made this exact list and finally felt myself an adult

Great checklist, though glad we don’t need health insurance in Scotland, its one less thing to worry about!

Great checklist – since to me, being totally independent is crucial and vital – I’m not exaggerating!

What a great checklist for growing kids! Thanks for this!

Love the checklist! So many young people are unprepared and this will help them get on the right track.

These are really great tips! I wish I read this post a few years ago. It’s such an intimidating leap to be on your own and completely independent. I wish I found this list a few years ago when I needed it as this sounds very helpful! I’m sure your post will help lots of people <3